Experience Tiranga Game, India’s premier colour prediction app. Secure login, daily gift codes, high payouts, and instant withdrawals—start winning today!

Tiranga Game is a skill-based colour prediction platform where you guess which of three colours—Red, Green, or Blue—will appear next. Fast rounds, up to 9× payouts, and real-time leaderboards make every play thrilling.

Redeem the exclusive Tiranga Game Gift Code below to get a ₹25 bonus on your first deposit of the day. Codes refresh every 24 hours!

Today's Code: 8522713375003

How to redeem: Open app → Wallet → Gift Code → paste & submit.

| App Name | Tiranga Game App |

|---|---|

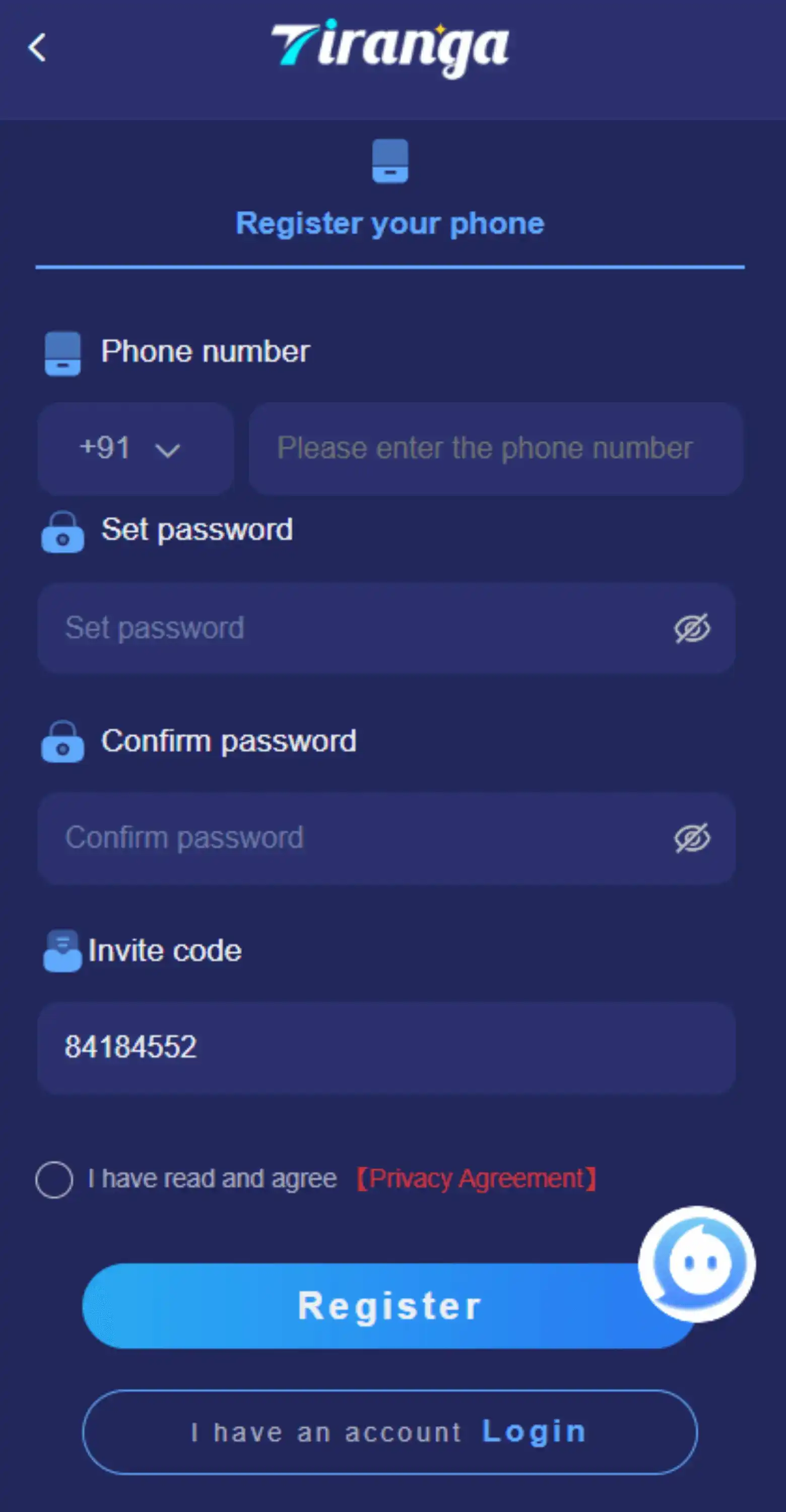

| Invitation Code | 84184552 |

| Daily Bonus | ₹25 on first deposit |

| Max Payout | 9× your stake |

| APK Size | 7.1 MB |

See our Download Guide for step-by-step visuals.

84184552 for a ₹30 sign-up bonus.

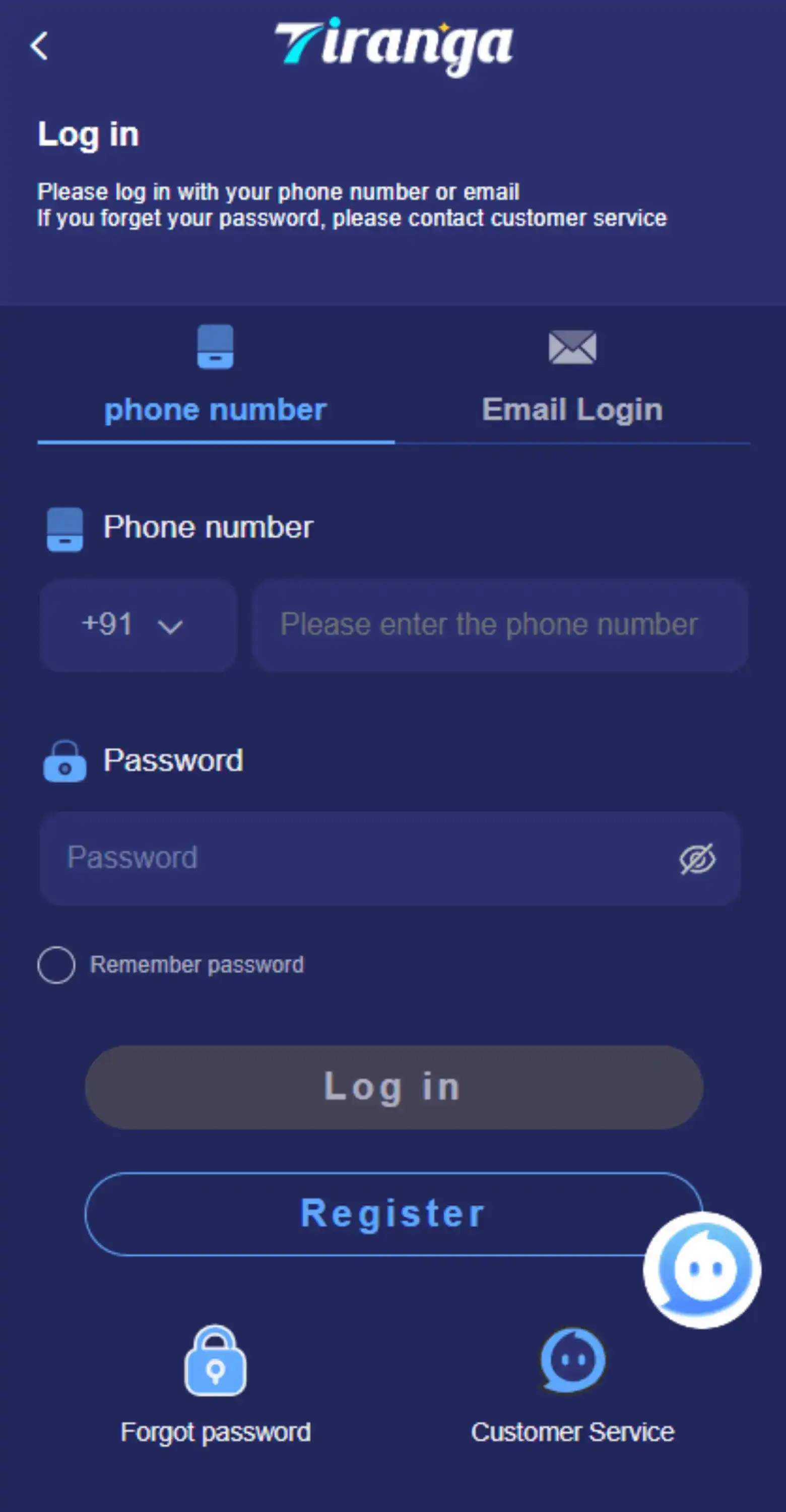

Forgot password? Tap Forgot Password to reset via OTP.

Each round lasts 30 seconds. Choose Red, Green, or Blue—match the result to win up to 9× your stake. Manage your bankroll and use proven strategies to boost your success rate.

Check out our Colour Trading Guide for tips.

Share your referral link to earn up to 80% commission on friends’ net losses. No cap—refer more, earn more. Track everything in the Agent Center.

A colour prediction game where you guess the next colour and win real cash rewards.

Go to Wallet → Gift Code in-app, enter your code, and submit to claim instantly.

Yes — Tiranga Game operates under India’s skill-gaming regulations and pays out winnings promptly to verified players.